Panellists:

- Tina Paillet, Chair of the RICS Europe World Region Board

- Vincent Clancy, Chairman and Chief Executive Officer, Turner & Townsend

- Janet Young, UK Government Chief Property Officer, Government Head of Property Profession

- Chris Brooke, Chair of RICS Governing Council and Real Estate Consultant

“This may be the watershed moment for construction to move into the 21st century”, suggests Tina Paillet, Chair of the RICS Europe World Region Board.

A recent digital debate among industry leaders in real estate and construction convened by RICS tackled the outlook for construction and real estate in the wake of the COVID-19 pandemic. While there was clear consensus that the short term will prove extremely challenging and test firms’ resilience, longer-term success depends on the built environment profession’s ability to embrace and capitalise on structural and behavioural changes that the virus has accelerated.

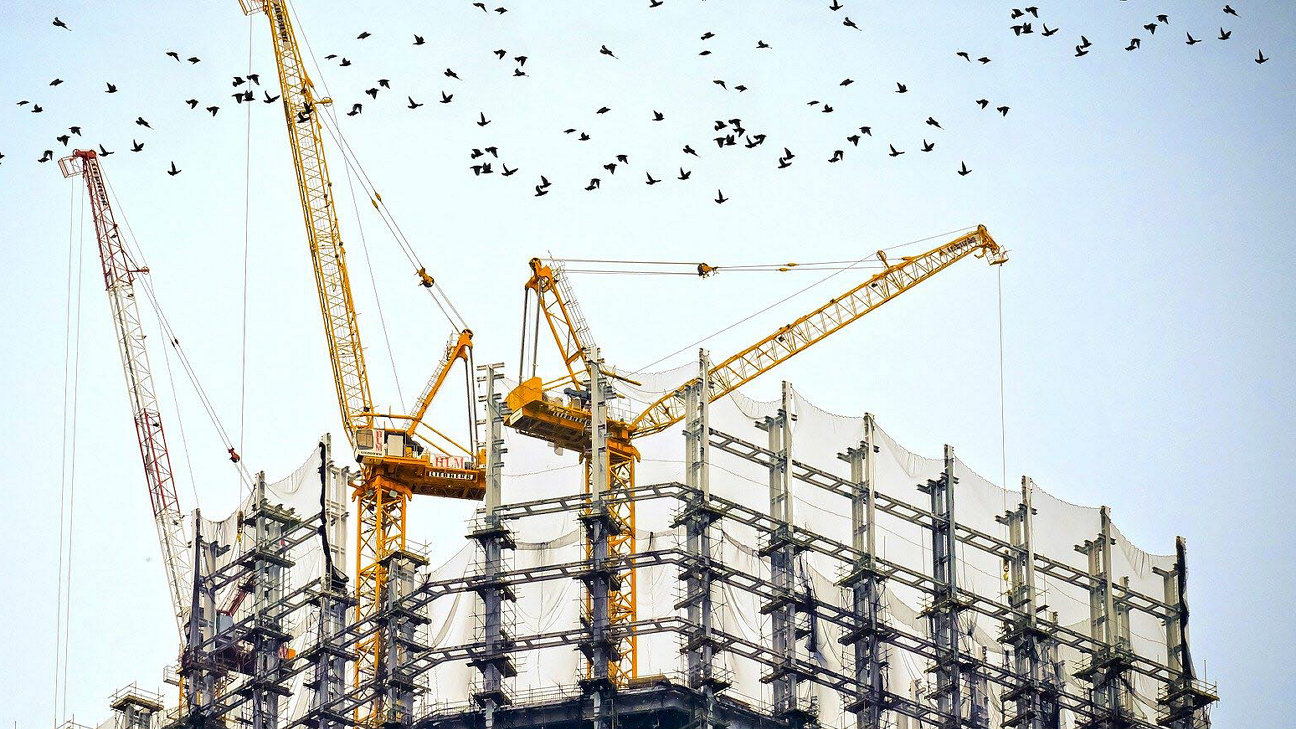

Short-term challenges in construction

In the short term, challenges abound in construction. That’s certainly the picture our latest series of Construction and Infrastructure survey paints. As Vincent Clancy, Chairman and Chief Executive Officer of Turner & Townsend noted, stopping activity on construction sites has seen knock-on effects throughout the sector, hitting contractors, second and third tier suppliers alike. And he points out that even as certain parts of the globe see construction sites start to re-open, necessary new working practices and social distancing will continue to affect productivity, as we detail here. To Clancy, this suggests “recovery doesn’t really mean recovery and we are going to moving into a new way of working for the end of this calendar year and certainly beyond…”

Looking beyond the initial public health crisis, Clancy notes the construction industry is typically first into recessions, and last out, and particularly susceptible to downturns. We have typically seen a collaborative and resilient response from industry, with participants working pragmatically with each other rather than going to the contract. However, with this economic backdrop, the industry will face additional strain as demand reduces and businesses’ commercial models evolve by necessity.

Paillet, however, highlights that while painful now, these very challenges will accelerate change to modernise the construction industry, stating that offsite and modular construction, and robotics onsite, will become more the norm than the exception. Clancy agrees: “We are going to shift towards an industry where we manufacture then assemble rather than build”.

Real estate undergoing structural upheaval

Construction is not the only part of the market where the current crisis is accelerating structural change. Chris Brooke, Chair of RICS Governing Council and Real Estate Consultant, highlights that COVID-19 has sped up existing changes in consumer behaviour and expedited adoption of technology. Retail has been heavily affected, with pre-existing issues exacerbated. Brooke sees a move to omnichannel service as fundamental to survival for retailers; the department store model, and those that are unable to adapt to social distancing will face the steepest challenge. For instance, is experiential retail compatible with social distancing?

Logistics will be one of the beneficiaries, as ecommerce expands, and companies reconsider the nature of their supply chains. But we can expect change within this sector too. Brooke suggests more local sourcing may drive a different approach in terms location, and how assets are linked to local infrastructure. As Paillet observes, last mile distribution centres will grow in importance.

Demand for and use of office space will change too. “We’ll see occupiers question the amount of space, type of equipment… how its laid out, how it’s managed.” Brooke also foresees a positive shift in the landlord-tenant relationship, believing landlords will increasingly work directly with building activation businesses and hospitality buildings to engage with tenants.

Looking to the future as we react to the present

As we come to terms with the immediate strain COVID-19 has brought, looking to the future is not easy. However, failure to do so will also come at a cost to businesses, our profession, and our environment. Janet Young, UK Government Chief Property Officer and Government Head of Property Profession, highlights development of talent as a particular concern. She believes that it is crucial the profession retains recruitment pipelines into the recession. She notes that apprenticeships and graduate programmes are often the first to go amid cost-cutting measures, but doing so has a lasting impact on our ability to deliver as a profession.

“As we come to terms with the immediate strain COVID-19 has brought, looking to the future is not easy. However, failure to do so will also come at a cost… ”

Building a sustainable recovery

Embedding sustainable practices is also vital as our sectors evolve in a post-pandemic world. This is a view shared by RICS, as articulated by its President, Tim Neal here. Indeed, Paillet highlights the decrease in pollution that has emerged as a side-effect of government lockdowns, but warns that “history shows that after economic and political crises, pollution levels go back up.” The health benefits of reducing pollution in the context of the pandemic provide more impetus for change as governments explore how to make urban areas more resilient; Paillet notes that those cities with the worst pollution have seen a more severe health impact.

Helping channel in future investment into sustainable infrastructure projects will be key. Young pointed to the strong mandate that the UK government has to invest in infrastructure, and get to net zero carbon emissions by 2050. That has not changed. As Paillet argues, globally, we can’t lose sight of how the trillions of dollars of money that will be forthcoming in bailouts is used; it must be used responsibly to help affect positive change in our built and natural environment, in spite of COVID-19.