Hong Kong stands at the beginning of a new chapter, but how will new initiatives affect commercial and residential real estate? In the final part of this series, Donglai Luo, RICS Senior Economist, assesses the impact of new policy measures designed to support economic growth on Hong Kong’s property industry.

Risks for the property industry: residential market performance

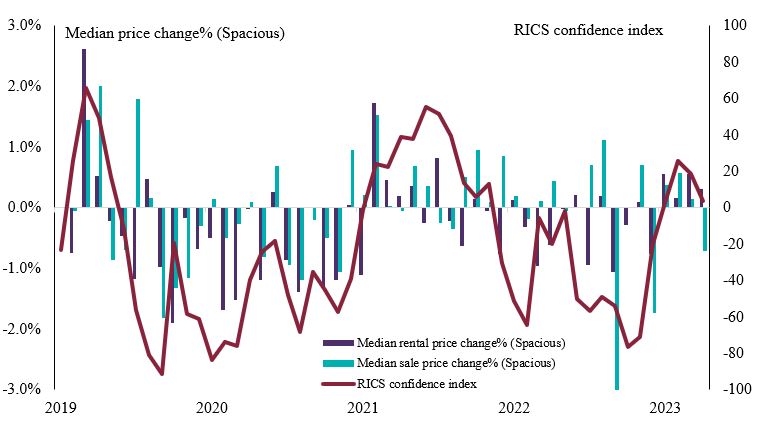

The recent economic turbulence has impacted the housing market, yet links with mainland China have led to outperformance of the New Territories. As shown in Figure 1, since 2019, the RICS confidence index has mostly remained negative, except for a brief recovery in the first half of 2021. As COVID-19 restrictions are lifted entering 2023, market sentiment is swinging upward.

Figure 1: Hong Kong residential market performance (2019–present) (source: RICS&Spacious.hk)

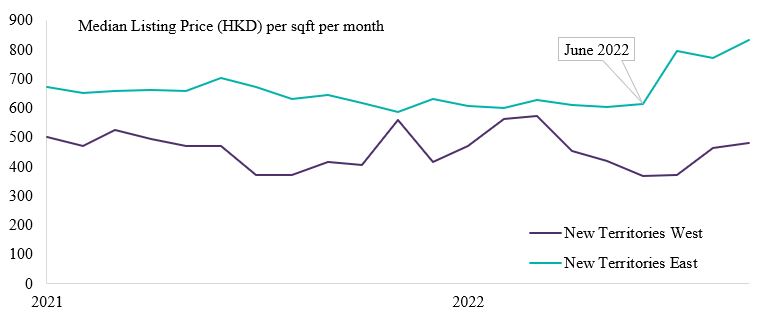

Using data from Spacious for subdistricts, we see early indications of a positive impact from lifting COVID-19 restrictions. As seen in Figure 2, soon after Hong Kong announced the lifting of some restrictions in June, such as the suspension of inbound flights and limits on public gatherings, there was a noticeable increase in the median rental price in the New Territories East where the portal to Shenzhen in Mainland China is located, compared to the New Territories West.

Figure 2: Rental comparison in the New Territories (source: Spacious.hk)

As economic ties with mainland China continue to deepen, being located close to mainland China has increasingly positive effects on the local residential market, as is also evidenced by Figure 3. As the New Territories directly connects Shenzhen, its confidence index has outperformed the other districts constantly. In 2018, the residential market in the New Territories was hit by high borrowing costs and high volumes of supply. However, it recovered quickly with the formal publication of Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area in early 2019. The advantage even widened during the pandemic and has largely endured the recent rate hikes. In summary, economic integration with mainland China will be a key factor influencing the performance of the residential market.

“Economic integration with mainland China will be a key factor influencing the performance of the residential market.”

Figure 3: District confidence index minus the city average (source: Macrobond)

The policy push and its impacts on the commercial property market

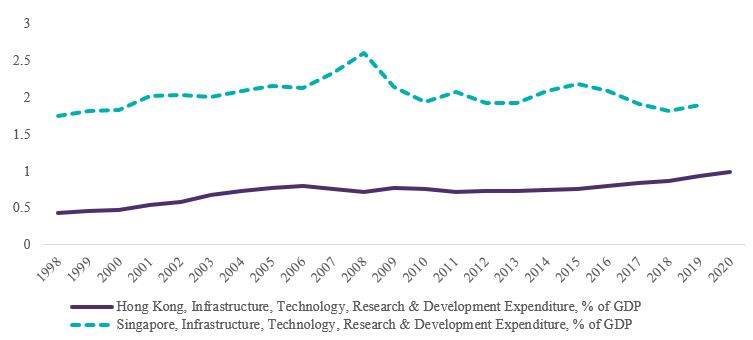

A novel policy change in the Greater Bay Area Development Plan is the emphasis of the technology and innovation. The efforts from policymakers can be seen repeatedly in the latest policy support, such as lowering the visa standards for tech workers, provision of funding and office spaces to tech start-ups, and open welcome of talents and tech companies. Judging by the noticeable difference in research and development expenditures between Singapore and Hong Kong shown in Figure 4, the motivation for this initiative is not unfounded.

Figure 4: Hong Kong vs Singapore, infrastructure, technology, research and development expense (source: Macrobond)

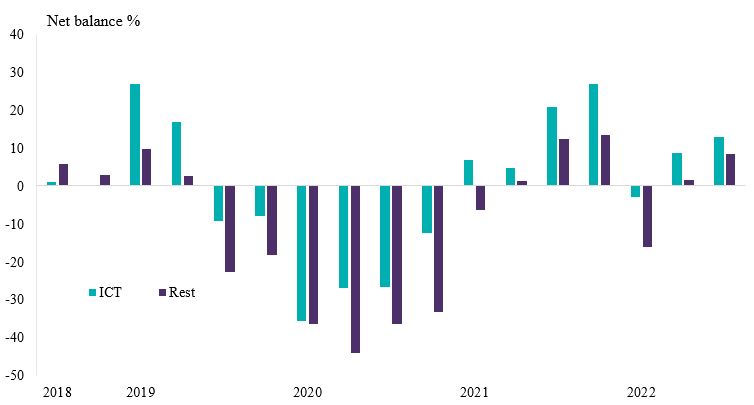

The RICS Global Construction Monitor results provide further evidence of this trend. As shown in Figure 5, the reading for ICT infrastructure workloads has outperformed the average of other categories since 2019, reflecting the government's efforts to boost the technology industry in the city.

Figure 5: Current Infrastructure workloads (net balance %) (source: RICS)

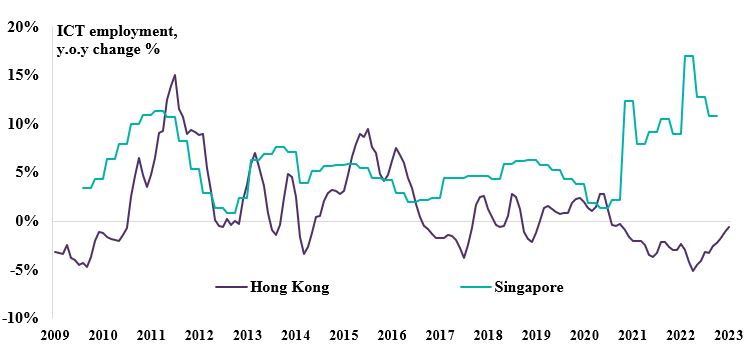

However, the administration’s efforts have not yet fully generated momentum in the tech industry, as evidenced by the employment trend in Hong Kong’s ICT sector. Shown in Figure 6, over the past two years, the number of employees in Hong Kong has decreased while it has boomed in Singapore. Figure 6 also shows that in the past years, the ICT employment growth rate in Hong Kong has been constantly eclipsed by that in Singapore, which is further proof of the gap between the two cities.

Figure 6: ICT employment, Hong Kong vs Singapore (source: Macrobond)

Talent outflow and office demand

Echoing the downward trend in employment in the ICT and finance sector, the latest official statistics show that the number of visas granted to mainland Chinese workers in Hong Kong decreased by 35% in 2021 compared to 2019, while visas for overseas workers declined by 67%.The unfavourable conditions deterring talents coming to Hong Kong not only hinder Hong Kong's aspirations as a global financial and competitive innovation hub but also have an underlying impact on the commercial real estate.

“The unfavourable conditions deterring talents coming to Hong Kong not only hinder Hong Kong's aspirations as a global financial and competitive innovation hub but also have an underlying impact on the commercial real estate.”

Take office demand as an example, Figure 7 clearly shows the negative impact from decreasing labour force participation on office demand. The correlation between the two factors is visible since 2014. If the decreasing trend in employment in key sectors such as ICT and finance persists, it would result in the decrease in demand for office space, which undoubtedly has a negative impact on its valuation.

Figure 7: Hong Kong labour force participation vs RICS office demand metric (source: censtatd.gov.hk, RICS GCPM)

Conclusion

Hong Kong is facing challenges not only from competition but also from the ever-changing macro-economic environment but is determined to maintain its status as a top financial centre. The city is reinforcing its traditional strengths in finance and logistics, while also investing in technology and innovation. Moreover, the new administration has implemented policies to attract overseas talent and support technology start-ups, and the lifting of COVID-19 restrictions and efforts to revive growth shows a strong resolve to overcome challenges. We expect an improvement in market confidence in 2023, but further evidence is required to confirm the sustained recovery of the real estate market.