Is this asset class set to outperform all others over the next decade? In the first of this two-part series, Tarrant Parsons, RICS head of market analytics, examines the rise of data centres and considers if growth can continue at such a pace given intensive energy requirements.

Secular shifts in workplace location preferences and consumer spending patterns continue to weigh on demand for occupancy across the office and retail sectors. At the same time, the evolving economic landscape is driving alternative uses for real estate.

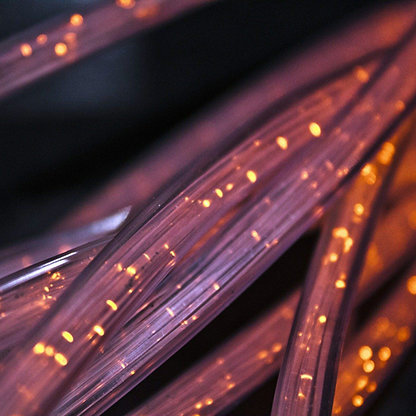

Data centres are used to store the physical infrastructure needed for delivering digital applications and have emerged as a clear beneficiary of technological advancements. While this asset class is forecast to continue to outpace other commercial real estate sectors in the next 12 months, will the expansion of data centres into new locations be tempered by rising costs and concerns over energy requirements?

AI and the demand for data centres

The demand for data centres has seen rapid growth over the past 15 years, due to expansion of the internet and web-enabled devices. Going forward, data centres will continue to see demand rise alongside the exponential growth in the amount of data produced and stored.

When put into perspective, the scale of this increase is staggering. According to data from Statistica, just shy of 150 zettabytes of data was consumed globally in 2024. Moreover, nearly double this volume of data is expected to be generated over the next few years, growing to 394 zettabytes by 2028.

While there are numerous sources from which this growth is being fuelled, perhaps the most significant driver has been the adoption of artificial intelligence (AI) and machine learning. Epitomising the surge in the use of AI, NVIDIA (a world leader in AI computing) has risen to become the third most valuable company by market capitalisation globally, having seen its share price soar 900% in the past two years alone. What’s more, the AI revolution is still considered to be in its infancy by many, with this trend set to propel a major new wave of data storage and processing requirements over the coming years.

Can data centres continue to outperform other sectors for capital value returns?

In a real estate context, according to industryARC, the data centre market is projected to grow by close to 10% per year between now and 2030. That would bring the total market size to $418billion by the end of the forecast period, up sharply compared to an estimated $220billion in 2022.

Over the shorter term, despite the downturn seen across many mainstream commercial real estate markets over the past two years or so, respondents to the RICS Global Commercial Property Monitor (GCPM) foresee data centre capital values rising by 3.2% at the global level over the next 12 months. In fact, data centres now exhibit the strongest expectations for capital value returns over this timeframe relative to all sectors covered.

The outlook is supported by robust occupier fundamentals, with global data centre leasing activity doubling in the year to Q2 2024 and hitting new record highs across the US, Europe and APAC in the process. As a result of such strong demand growth, revenue generated per available metre has increased by almost 8% in each of the past two years, on average, across the top US and European data centre markets according to Green Street statistics. Better still, Green Street projections point to this measure of performance rising by around 12% in 2024 and over 10% in 2025. The prospect of such exceptional income returns is sure to attract significant investment into the sector over the years ahead.

How will energy requirements and costs impact data centre locations?

Although the narrative around investment into data centres is certainly a positive one moving forward, there are still substantial challenges that need to be considered. Arguably the most pertinent issue is the pace of growth in the energy required to run these facilities, alongside increased high-power demand from sectors such as electric vehicle infrastructure and advanced manufacturing. Consequently, the capacity to generate power, along with competing uses, could limit the locations in which new data centres can be developed.

As it stands, Savills research estimates there are just over 1,250 commercial data centres across Europe (excluding self-built properties), with close to 130 new developments completed over the past three years. Roughly two-thirds of these are based in Western European nations, led by markets such as Amsterdam, Dublin, Frankfurt, London and Paris. Given the typically lengthy planning process around data centres, close to 65% of the upcoming pipeline to be delivered over the next four years will be situated in these locations as it will take time for approvals to be granted in new markets.

However, due to the large energy requirements, coupled with high land and construction costs, the supply potential across these markets will likely become saturated before long. Instead, alternative locations will then be targeted for data centre developments, with Savills suggesting these could include Prague, Genoa, Berlin, Munich, Milan and Cambridge.

Similarly, data centre locations are set to become more diversified across the United States. Kevin Boden, global Director of research at EdgeConneX now feels there is very little scope left to build in some of the established markets such as the Bay area. As an alternative, areas such as the mid-west are seen as providing good opportunities for development given greater availability of power and more affordable land costs.

Likewise in APAC, significant further expansion may prove difficult across the already crowded markets of Tokyo and Syndey, leading to Southeast Asia potentially becoming a heavily targeted area for new data centre locations in the future.

Overall, the industry is set to become less clustered, with the number of zones classified as primary data centre markets likely to widen substantially over the next five to ten years.

ESG impacts of an exponentially growing asset class

The commercial real estate market has certainly experienced a shake-up in the post-pandemic era, as previously established traditional sectors lose their appeal amid the changing needs of society. Data centres however, which were at one time just a peripheral asset class, have become an increasingly key market sector, with their importance only set to rise further in the years ahead.

While this rapid growth may set data centres apart as perhaps the most promising commercial property sector for investment returns over the medium term, there are understandably concerns around how this all fits in with global sustainability targets given the intensive energy requirements.

The next article will focus on the challenges around the energy usage of data centres and what innovations could help to reduce such intensive consumption.

Related articles