On 12 April 2025, 08:00 BST, we will be disabling logins for specific member-facing platforms to improve internal processes. We expect this to finish 12 April 2025 at 17:00 BST.

RICS has secured new insurance terms, providing greater fire safety cover for PII and launched new guidance on Risk, Liability and Insurance.

As of 1 April 2021 RICS new Minimum Policy Wording and insurance rules for professional indemnity insurance (PII) are in effect, which will allow more chartered surveying firms to obtain improved fire safety cover in their PII.

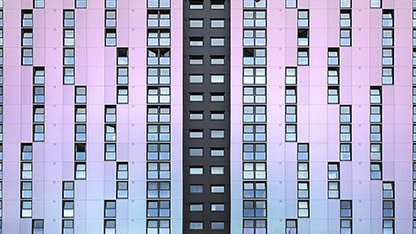

The new Minimum Policy Wording and insurance rules will mean that from 1 May 2021*, PII policies will provide greater fire safety cover for chartered surveyors. Under the new rules insurers are not permitted without specific dispensation to exclude fire safety claims on a property four storeys or less and fire safety coverage must be provided as a minimum on an aggregate, defence cost inclusive basis. Since 2020, insurers have imposed a blanket fire safety exclusion on PII terms provided due to concern following high profile fire safety failures, meaning chartered surveying firms have increasingly been left uninsured for fire safety exposure on all aspects of their business..

Hugh Garnett, RICS Senior Policy Specialist comments:

“In recent years, PII has become increasingly more expensive and difficult to secure, especially for smaller firms. In the past 18 months, we have seen increasingly stringent fire safety exclusions being placed on PII policies, reducing the protection for chartered surveying firms and the number of firms who have been able to offer professional advice on properties with fire safety issues.

“The change in minimum terms will provide a welcome relief to chartered surveyors who have been unable to obtain fire safety cover and will mean that firms renewing their PII policies from 1st May will have greater fire safety coverage.

“We continue to work with Government and other industry stakeholders to find practicable and affordable solutions for the profession for properties over four storeys, with the Government’s commitment to developing an indemnity scheme for EWS1 completers.

“RICS professionals have a vital role to play in helping find resolutions and these new terms will mean firms are better protected for their work to navigate this current crisis.”

“RICS professionals have a vital role to play in helping find resolutions and these new terms will mean firms are better protected for their work to navigate this current crisis.”

Hugh Garnett, RICS Senior Policy Specialist

New Guidance – Risk, Liability and Insurance

In addition to the changes to the minimum policy wording RICs have launched a Risk, Liability and Insurance Guidance Note to support RICS professionals and their clients. The note sets out the main risks and liabilities associated with professional services provided by RICS members and offers guidance on how to effectively manage those risks, understand them whilst managing and limiting liabilities.

*Minimum Policy Wording will come into effect on 1st April 2021, but insurers have a dispensation for a month on fire safety and the improved fire safety cover will come into effect on 1st May 2021.