The Royal Institution of Chartered Surveyors (RICS) has submitted its response to His Majesty’s Treasury 2025 Spending Review, calling on the UK Government to take decisive action to enhance the built environment, streamline property transactions, and support the transition to net zero.

Addressing key issues across residential, planning, sustainability, skills, conservation, and digital transformation, RICS urges policymakers to implement critical reforms for the benefit of consumers, businesses, and the economy.

The following is a summary of our broader response.

Residential: Strengthening the Home Buying and Selling Process

To reduce financial losses for consumers and increase Treasury revenue, RICS calls for the government to explore options to introduce upfront property condition surveys, undertaken by a professionally competent surveyor, completed in accordance with the Code of Measuring Practice, 6th edition, presented at the time the property is listed and available to all interested buyers.

Planning and Development: Reducing Delays through Mediation

RICS advocates for the integration of Alternative Dispute Resolution (ADR) into Section 106 (S106) agreement negotiations. By embedding ADR processes, facilitated by RICS as a trusted provider, the Government can help prevent unnecessary delays and streamline planning approvals.

Sustainability and Net Zero: Mandatory Carbon Measurement, Retrofit and Green Skills

RICS calls for the Government to introduce legislation requiring the measurement and reporting of embodied carbon in line with RICS standard, as recommended by the Environmental Audit Committee in their report of May 2022. Additionally, RICS calls for the expansion of the Energy Skills Passport Pilot to include surveyors, enabling professionals to support the renewables sector’s growth. Greater inclusion of skilled professionals in government-backed retrofit programmes is also needed to improve installation quality and enhance public confidence.

Skills and Workforce: Bridging the Skills Gap

To build a resilient workforce, RICS urges the Government to expedite measures addressing skills shortages in the built environment sector. Strengthening the workforce is critical to boosting productivity and meeting national objectives.

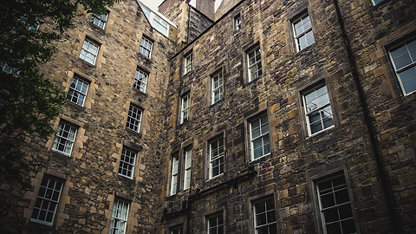

Conservation and Heritage: VAT Support for Preservation Works

To encourage the restoration of historic buildings, RICS calls for VAT support on heritage preservation projects. Aligning VAT treatment with new build dwellings will provide economic, environmental, and cultural benefits while preserving the UK’s architectural heritage.

AI & Digital: Investing in Tech Skills for the Future

RICS supports continued investment in upskilling funds to subsidise AI and digital training in the Professional and Business Services sector. Through the RICS Tech Partner Programme, the organisation advocates for a holistic approach to digital adoption, enabling AI to enhance decision-making in carbon modelling and residential valuation.

Published date: 10 February 2025