Business not-as-usual: are we ready for the commercial real estate revolution?

This is a fascinating period to be active in the commercial real estate space. Technological change and a generational cultural shift are causing enormous disruption to business and to society at large. While the real estate industry has always been subject to evolutionary change and reinvention, the speed at which that process is taking place is constantly accelerating. Within our sector, the valuation profession will need to stay abreast of developing trends and, to the best of their ability, quantify the impact of those changes on value.

Technological advances – ecommerce, artificial intelligence, blockchain, the internet of things, autonomous vehicles – are combining with a changing set of values among the millennial generation to set the working world on its ear. When my daughter finished college, and began work in New York City, the phone conversations between her and her friends were not about what they were earning in their new jobs. Instead they were sharing pictures of their workplaces to find out who had the coolest office space with a ping-pong table and kombucha on tap. Her generation is focused on having a good quality of life and on amassing experiences rather than wealth.

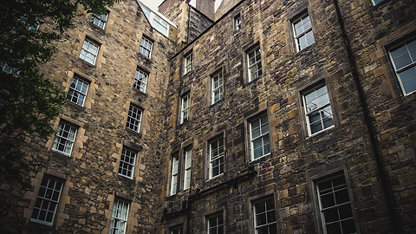

Office buildings are incorporating tenant-only amenities such as outdoor roof terraces, food halls, exercise facilities and bicycle storage. Co-working has grown exponentially with the likes of WeWork, Knotel, Servcorp and Convene focusing on providing a sense of community while curating the tenant experience by providing a higher level of design and service, but still on flexible terms.

Because of the millennials' focus on rewarding experiences and good health we have seen a renewed interest from landlords on wellness, natural light and fresh air. The use of sensors and monitors within offices is ever-increasing, and the big data gleaned from them allows occupiers and landlords to curate and improve the building experience.

Millennials also have an elevated consciousness of environmental issues and enabling the measurement of building performance has supported the expansion of sustainability and wellness certification schemes such as LEED, Fitwel and WELL. There is value there too. Because employees demand better standards of wellness and sustainability, it is something that corporate occupiers must consider when renting or building space.

The value that can be ascribed to a greener, healthier building is determined by how much more rent an occupier is willing to pay for those qualities; however, there has not been enough empirical evidence to suggest that there is a defined value increment. We are not yet at the point where we can identify whether a LEED-certified building is 10 per cent more valuable than a non-certified one. It is difficult to find perfectly comparable cases, but the more information we collect, the more accurate we will get at estimating the incremental value.

Technology is also having a direct impact on the way that valuers carry out their work. In years past, when appraising a property, you would go to the relevant town or city hall to get tax or zoning information about a building that you would then take back to your office and incorporate into your appraisal. As time went on you could do that on your desktop via an internet connection: instead of taking half a day it took 15 minutes.

Now, valuers have access to software that allows them to punch in an address and incorporate that information automatically into their report. If what currently takes 15 minutes can be reduced to 10 seconds, that adds up when you are doing hundreds of reports a year. A similar approach could be used for garnering comparable data on sales and leases for review by the appraiser and possible inclusion in their evaluation.

“When my daughter finished college, and began work in New York City, the phone conversations between her and her friends were not about what they were earning in their new jobs. Instead they were sharing pictures of their workplaces to find out who had the coolest office space with a ping-pong table and kombucha on tap.”

We don't yet appraise in real time by providing instantaneous property valuations, but things are clearly moving in that direction, and the ability to do so could prove to be vital in light of trends that may dominate the future of property investment. Blockchain technology, which can be used to create a digital ownership share, known as a "security token," and enable it to be traded cheaply, is at a nascent stage. Nonetheless, it offers a huge potential in that it could enable the average citizen to purchase a small interest in a large piece of real estate very transparently and efficiently.

A number of things need to happen to make that a reality, not least the widespread adoption of blockchain. Meanwhile, decisions need to be made on whether the digital coin used to purchase tokens should be tied to a hard currency. It is, however, something to keep a close eye on from a valuation perspective because when a purchaser buys that tokenised real estate share, they need to know what that property is worth at that particular moment, just as they would if they were buying a stock or a bond. Real estate is currently a much more imperfect market than the stock or bond market and it will have to evolve to provide a real-time pricing model in order to support that ecosystem.

At present that seems a daunting task, but it is possible to imagine doing a baseline valuation on a quarterly or monthly basis and in the intervening periods putting in place some kind of system which tracks anything that potentially impacts the property value – if, for example, a tenant moves out, or a new contract is signed that changes the building's insurance costs.

Because of the accelerating pace of change, valuers will need to become more tech-savvy and better able to use the systems that will become available to us going forward. We will need to be keen observers, keeping an open mind in terms of how we evaluate the various trends and technologies we encounter, and then linking the effects they produce with their impact on value.

Turnaround times for commercial real estate valuations have been shrinking for years and will continue to do so. As valuers we find ourselves called upon to provide the result of our evaluations faster and faster, and at a lower cost. The way we answer that challenge has to be through the more extensive use of technology. Meanwhile, the wider availability of more detailed data to market participants means that, with many forms of data, our clients have access to the same information that we have.

As a profession we can still make a crucial contribution by providing our clients with insight into what is going on behind the numbers: what story may need to be told about a property or submarket that is not yet available on the internet; what is going on behind the scenes; what is happening in that market that may not yet be widely known; what views investors, lenders and owners hold on that particular property or market. Whatever technological and cultural changes we may see in the future, that actionable advice and information will continue to be the value-add proposition that appraisers contribute to the real estate business.

Eric Lewis is President, Valuation & Advisory Americas at Cushman & Wakefield.